What happened to Glossier

If you step into a Sephora store a week from today, you’ll be greeted by a display plastered in a familiar shade of millennial pink.

Glossier has finally landed at the multinational retail chain. Nine years ago, the company launched with a bang as a direct-to-consumer beauty brand designed to give customers a natural, dewy glow. On February 23, those customers can source the entire product line at every one of Sephora’s 600 locations across the U.S. and Canada. The launch is designed to reach an audience beyond the brand’s early fans, who were primarily digitally native women in their twenties and thirties.

At the same time, Glossier is expanding its own brick-and-mortar footprint. Tomorrow, it opens an immersive new flagship store in Soho, New York, outfitted with selfie-perfect backdrops—like a large subway-style mosaic and a carnival-style claw machine dispensing Glossier merch.

Kyle Leahy, Glossier’s new CEO, orchestrated these moves. She took over the top job from founder Emily Weiss in May 2022 after a period of turbulence at the company. During the pandemic, Glossier laid off a third of its staff while also being accused of racism, toxic workplace culture, and a lack of product innovation.

Leahy, who came from shoe brand Cole Haan, has been tasked with righting the ship. She has her work cut out for her. She’s expected to scale the company quickly to meet the demands of investors who poured $266.4 million into the brand over the course of its first seven years in business, giving Glossier a valuation of $1.8 billion in 2021. (The company chooses not to comment on whether it is currently profitable.) At the same time, Leahy will need to rehabilitate Glossier’s image, which was tarnished during the pandemic.

If these hurdles can be overcome, the question is whether Glossier can mature beyond its status as a beauty upstart and compete against giants like L’Oréal and Shiseido. That’s certainly Leahy’s plan. “We’re in year eight of a 100-year-old brand,” she says.

FROM BLOG TO BRAND

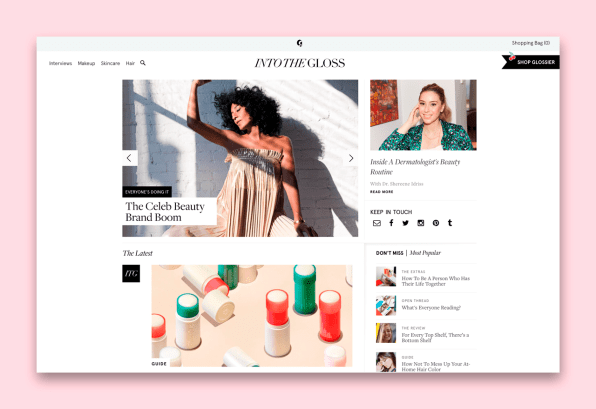

In 2010, Weiss, a young fashion assistant at Vogue magazine, started a blog called Into the Gloss that offered a glimpse into the beauty routines of interesting people, from art gallery directors to actresses. In the early years, Weiss took many of the photos herself, choosing to present women in a natural way, with minimal makeup.

As the website developed a following, Weiss had the idea of leveraging its popularity to launch a beauty brand that would create the “no makeup” aesthetic that she had popularized. Having spent years delving into dozens of women’s makeup routines, Weiss was well-versed in the brands and beauty products on the market.

In 2014, at age 29, Weiss pitched her idea to dozens of VCs. One of her earliest supporters was Kirsten Green, the founder of VC firm Forerunner Ventures, which had launched other direct-to-consumer brands like Warby Parker and Birchbox. Green provided seed funding but also opened doors to other investors, like Thrive Capital, which led Glossier’s $8.4 million Series A round. In a male-dominated startup world, Weiss’s fundraising success was exceptional.

Weiss proved herself to be a skilled marketer. Reporters and influencers received early samples of products in cute pink boxes and pink bubble zipper bags that included stickers and swag that they shared on Instagram. The brand launched with just four items—a balm, a facial mist, a sheer skin tint, and a moisturizer—all of which promised to create a healthy, youthful glow. Glossier teased products on social media before launch, and fans went wild the day the site officially went live.

HOW GLOSSIER LOST ITS SHEEN

This early popularity helped Glossier land new rounds of capital every couple of years, as it burned through cash in an effort to scale quickly and become a dominant player in the beauty sector. Its ads blanketed Facebook and Instagram, easily acquiring customers online; it launched fun pop-ups around the country saturated in the brand’s iconic pink. Eventually, Glossier opened beautiful stores in New York, San Francisco, and Chicago.

Weiss was judicious about launching new products, arguing that the beauty industry was already overcrowded, that it made sense to launch only items that were unique. The Boy Brow eyebrow groomer and Milky Jelly Cleanser were hugely popular, but Glossier’s customer base craved more newness, particularly since the makeup industry is famous for its velocity of product launches.

In 2019, Glossier gave customers what they asked for in the form of Play, a colorful makeup line full of sparkly eyeshadows and bold lipstick colors that was a stark departure from its other products. When I spoke to Weiss at the time, she said that the goal was to spin off new brands every few years. But it became clear that the strategy wasn’t working when the brand shut down Play the following year after disappointing sales. “It was a really constructive learning process for us,” Green of Forerunner Ventures told Business of Fashion at the time. “Do we wish we could learn things cheaper? Yes.”

But troubles kept coming from there. In 2020, in the wake of the murder of George Floyd, Glossier employees past and present spoke up about Glossier’s toxic workplace culture, in particular around what they said was the mistreatment of workers of color. In an Instagram account called Outta The Gloss, they documented racist incidents, like a woman using a Black employee to “show off” her complexion to a friend, and white teenagers using dark foundations in one of its stores to look Black.

In 2022, hot on the heels of raising $80 million six months earlier, Glossier fired 80 employees—a full third of its staff. Weiss took responsibility for the layoffs, saying that the company got ahead of itself on hiring by prioritizing brand expansions like Play rather than focusing on acquiring new customers. In a statement Weiss said, “Over the past two years, we prioritized certain strategic projects that distracted us from the laser focus we needed to have on our core business: scaling our beauty brand. We also got ahead of ourselves on hiring. These missteps are on me.”

THE NEXT CHAPTER

Leahy stepped into the role of CEO in May 2022, after serving as Glossier’s chief commercial officer for 18 months. As she surveys the past few years, she argues that Glossier’s struggles have often come from its lack of focus. “This brand has incredible opportunity to play in different arenas,” she says, referring to things like the Play launch. “Sometimes, when you have that, you can get distracted. We have the humility to go back to what makes Glossier unique, which is a beauty brand that is of, by, and for our community.”

She’s now picking up Weiss’s mantle of scaling Glossier. The Sephora partnership is a quick way to do this. Leahy argues that Glossier has built enormous customer demand; the brand’s research suggests that half of women ages 18 to 34 in the U.S. are aware of the brand. Yet Glossier currently commands less than 1% of the $500 billion beauty industry. This means that it needs to deliver products to consumers around the country quickly. Given its vast brick-and-mortar footprint and online presence, Sephora can certainly help.

Glossier took a long time to embrace the benefits of selling through a retailer. In some ways, wholesale is in direct contrast to Weiss’s original vision for the brand, which was to connect with consumers intimately—without a middleman impinging on that relationship. But as I’ve recently reported, many direct-to-consumer brands have struggled to grow through their own channels and have turned to retailers to reach new customers, like Everlane via its Nordstrom pop-ups and Harry’s with its Target partnership.

Leahy argues that Glossier has built a strong community and can now enter retail without damaging its relationship with its customers. “Direct-to-consumer is just a channel,” she says. “Our value proposition is that we’re a community-oriented beauty brand that connects deeply on an emotional level. Brands like Nike or Apple that have emotional resonance can do so across channels.”

Glossier customers continue to complain about the brand’s lack of new products. On a Reddit thread from a year ago called Is Glossier in its flop era?, fans talked about how they were losing their passion for the brand. “The truth is glossier is not special anymore,” one writes. “Lots of other brands are making natural beauty makeup for cheaper and with more diverse shade ranges.”

Leahy has heard this feedback loud and clear. “We’re deeply listening to our customers,” she says. “Our teams are trawling Reddit.” She’s investing in Glossy Labs, the brand’s product development hub, so that it can roll out new products at a pace of every four to eight weeks, rather than quarterly. In January, Glossier launched deodorant after years of customers asking for it. Based on customer feedback, it also reformulated one of its most popular products, Balm Dotcom, swapping out nonrenewable petrolatum with plant-based castor jelly and outfitting it with a hands-free applicator. Glossier says it sold $1 million worth of the balm in one week.

The changes appear to be working. After months of sluggish sales, Leahy says that Glossier saw 26% growth in the second half of 2022, and its fourth-quarter sales were the largest in its history. “We’ve made significant strides on profitability,” she says.

Ultimately Leahy is choosing to see Glossier’s recent troubles as merely bumps in a long road. “Every brand has chapters in its story it has to learn from,” she says. “But you have to continue to drive forward.”

Source: Fast Company